Genesis Block Created: Sunday, January 19, 2014 03:54:41 GMT

In this article, we explore the impact of the “instamine” on the Dash ecosystem. There’s been talk from the very beginning of Dash about the very first 24 hours, 1.9 million coins were issued. We gained access to Evan Duffield to directly answer some questions about the instamine and give us an account of what happened.

Q: Did the instamine happen?

Evan Duffield:“The instamine happened, there is no one disputing that fact. The crypto-community at large has no problem with this except a few who think it’s trying to be hidden in some way. In fact, I posted multiple times about the instamine, first in “The Birth Of Darkcoin” which is an account of the first few weeks of the launch and the mistakes that were made. Recently I also posted spoke about the Instamine in the video “Virtual Corporation”, which considers the concept that it might have been key to Dash’s success, which I believe now.

It’s also important to note, I was working a very challenging day job while working on Dash in the first couple weeks. So I was putting out fires every night, keeping tabs on Dash during the day (while getting yelled at by my boss when he caught me a couple times). Eventually I quit when I got Dash stable enough to work on full time and decided I really wanted to explore what I could do with it. “

To analyze the first 24 hours we need to establish some facts :

1) We current have about 5,810,000 coins outstanding

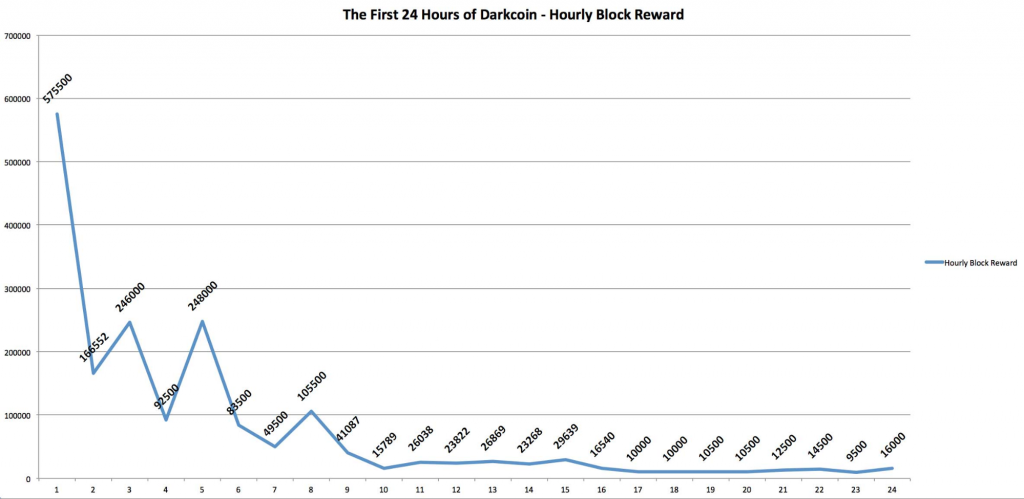

2) During the first 24 hours there was about 1.99 Million coins issued

3) Evan’s point in the above video is that, without the instamine Dash would not have captured the interest of it’s Founders. It’s also stated that there was a large selling of coins, where miners that were only out to make some money sold their coins on the open market.

Evan Duffield:“Early after the launch, the main exchange Dash (Xcoin at the time) was traded on was hacked and all coins were stolen then dumped on Poloniex. This was one of the darkest moments of our history and many people got hurt badly by this attack. However, this created another distribution event where hundreds of thousands of coins were sold in a period of about a day. Between this and the early distribution, we successful distributed the currency to a multitude of investors in record time. ”

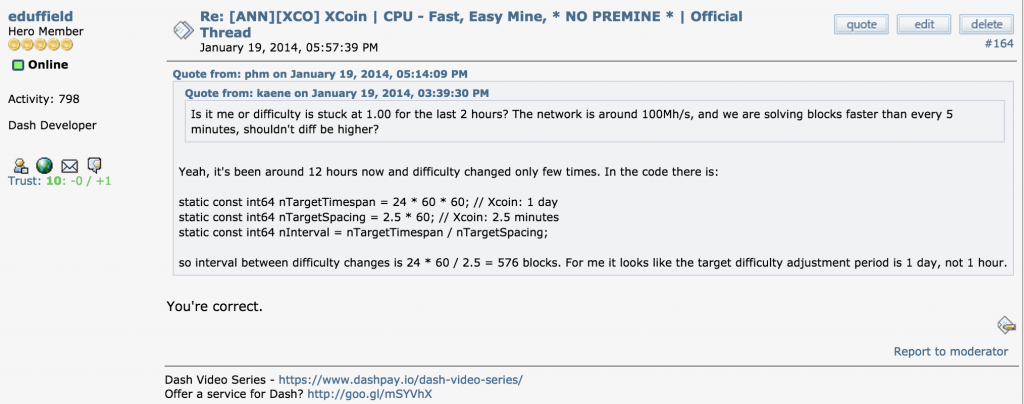

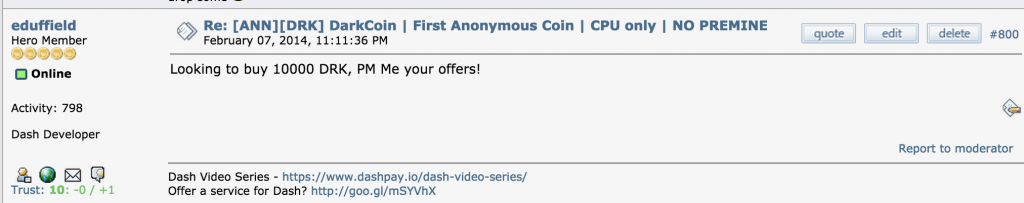

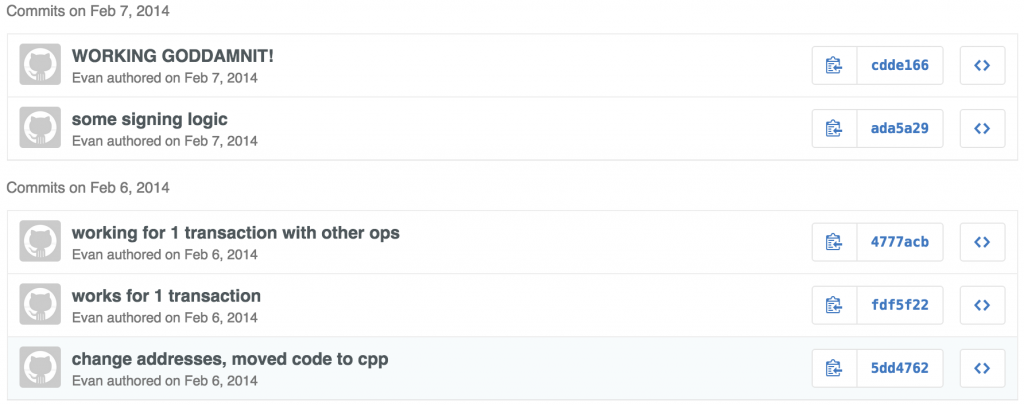

4.) Was there any other proof that it was accidental? If you look through Evan’s early posts and commit history, it’s very clear there was a lot fires going on in the codebase that he was trying to fix, while working a full time job.

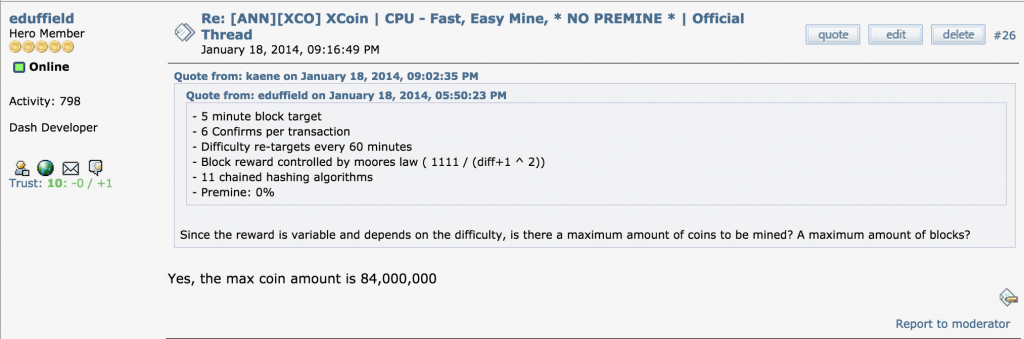

The max coins were set to 84 million, but the coin had generated 2.5 million coins. Dash would have been over it’s limit in a 1.5 months and collapsed:

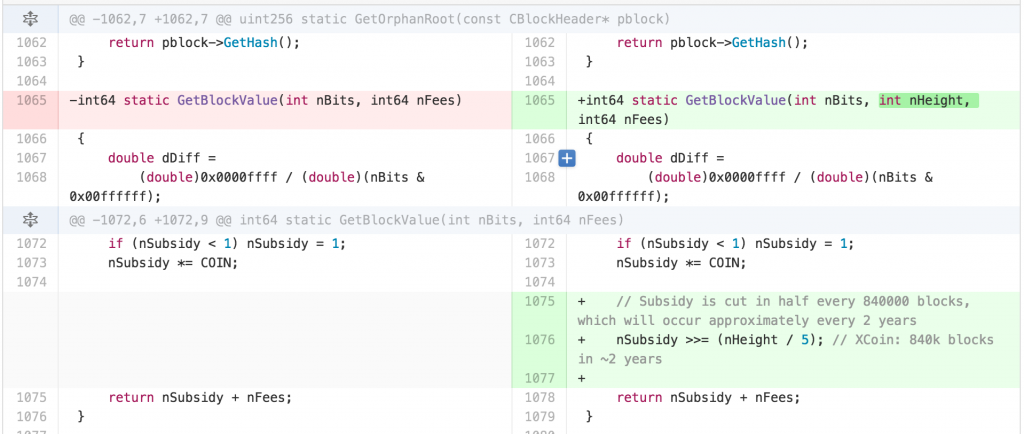

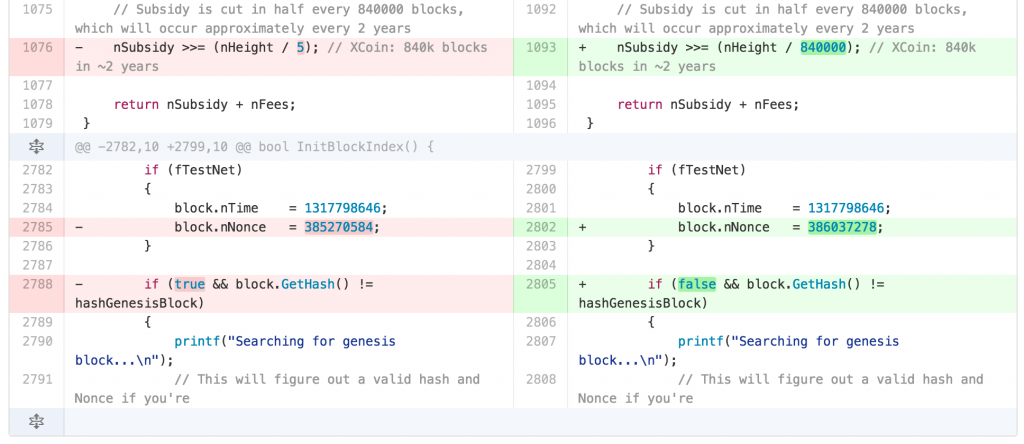

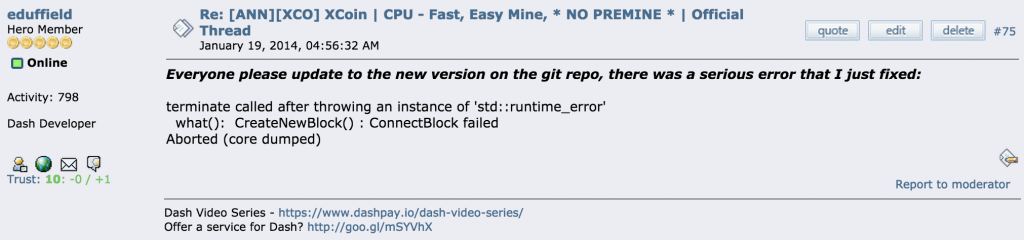

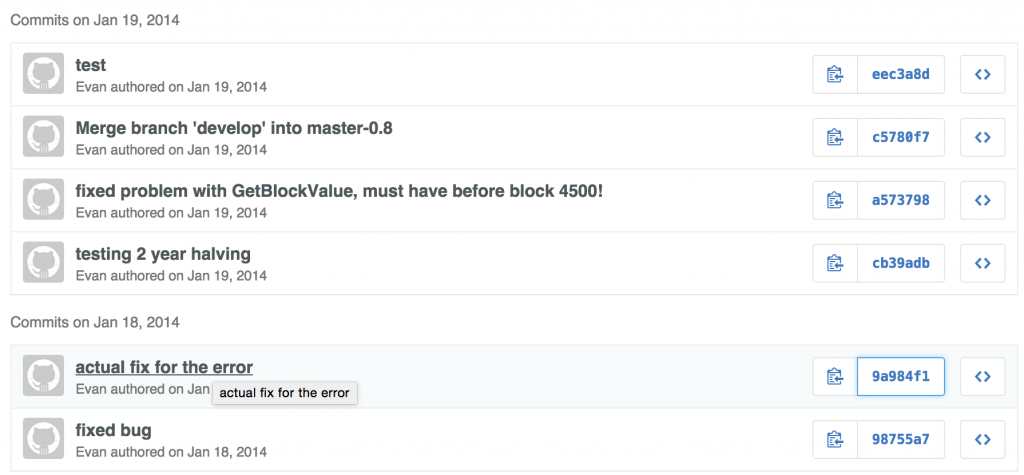

Evan updates the code a multiple times trying to save the currency as fast as possible:

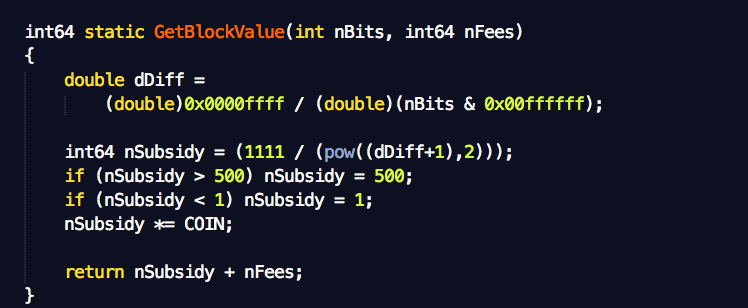

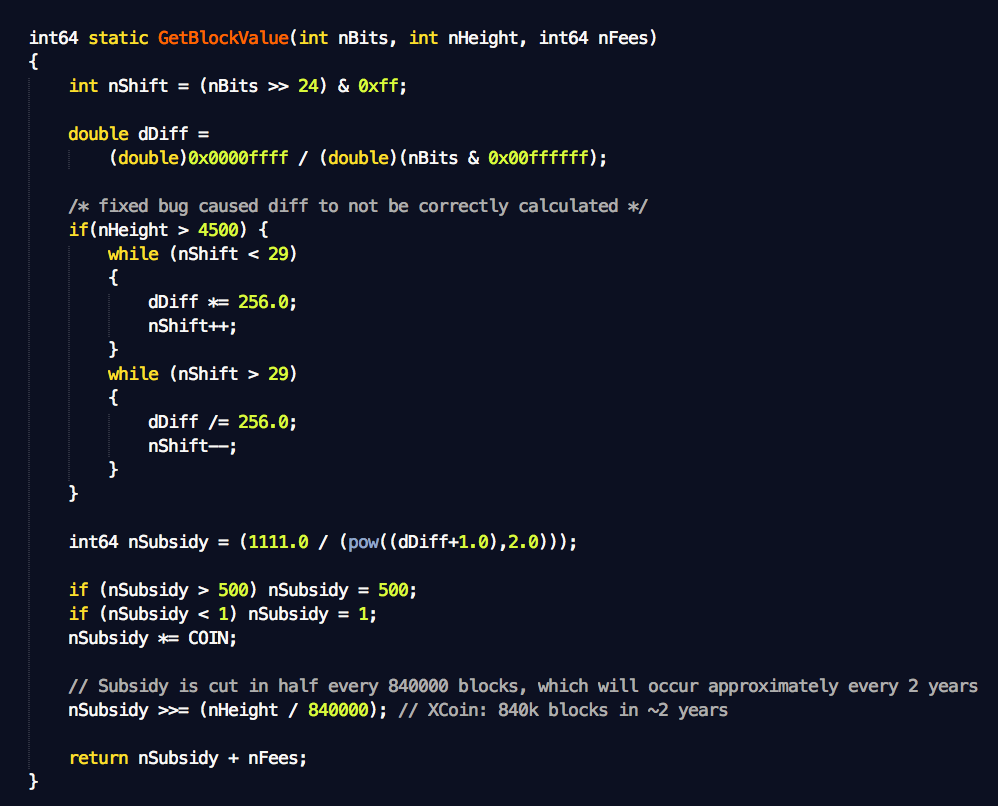

Evan Duffield: “An error can be seen in the first block calculation function ‘GetBlockValue’, which incorrectly converted the difficulty, then tried using a corrupt value to calculate the subsidy, causing the instamine”:

Evan Duffield: “I fixed the issue with GetBlockValue in @9a984f1, “Actual fix for the error”, which implements a simple conversion from nBits to a double to correctly calculate the difficulty.”

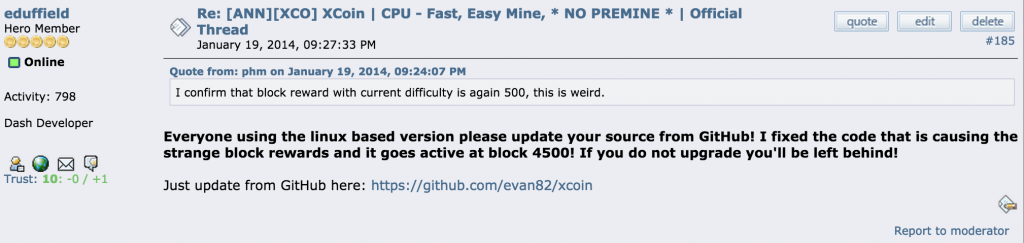

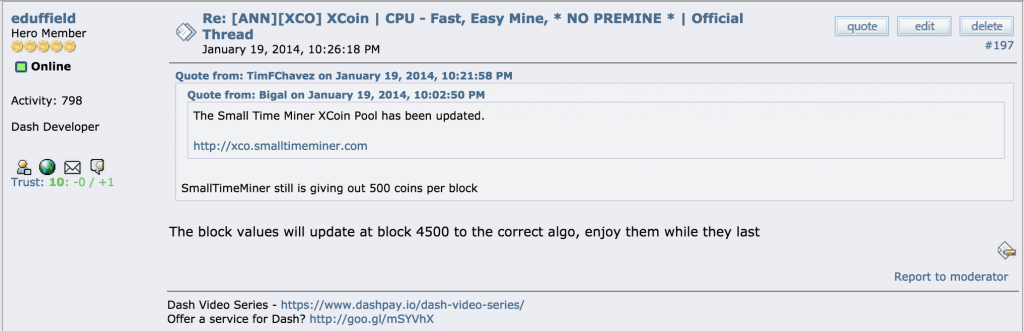

Even after the initial fixes, there were still bugs (everything is still on fire):

Evan updates the GitHub code, to try and reduce the generated supply to a maintainable level by hard-forking the currency:

Dash was buggy at the beginning, I don’t think anyone on earth could have faked this. It was obviously an accident and well intentioned mistake. All work above was done late at night, after Evan worked his day job. Why would he work so hard on a project that was just to scam investors?

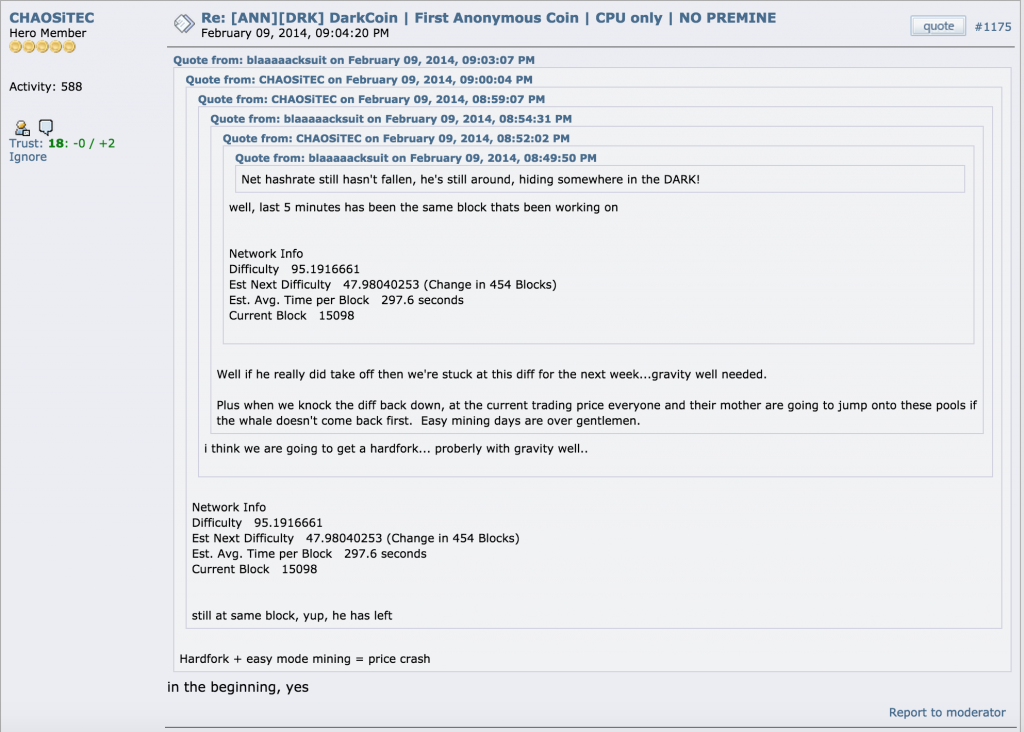

Evan Duffield:“Even after the first few subsidy fixes were implemented, the network still had problems. The next issue was a whale attack. They attacked the network for 10k+ DASH in a few hours, then left us to suffer. We had Bitcoin’s terrible readjustment algorithm, which doesn’t deal well with substantial hashrate loss.”:

Soon after this, Evan implemented Komoto gravity well, then Dark Gravity Wave later on to protect the network from this type of attack.

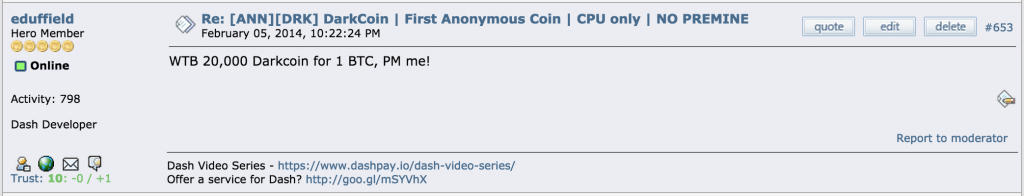

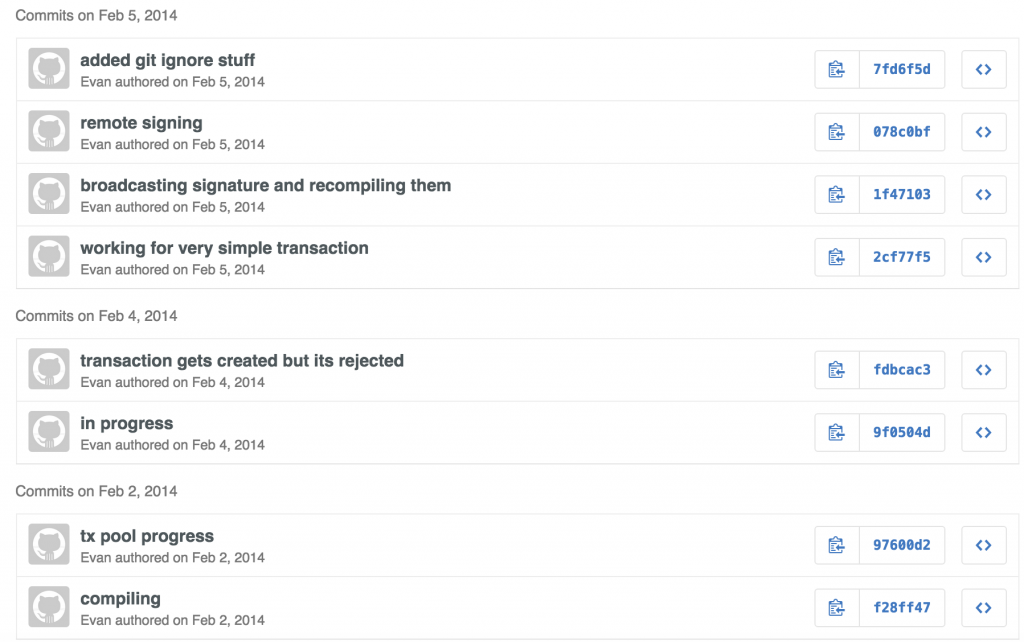

Next, after regaining stability, Evan started buying his own coin:

5) Why is he buying coins if he’s just going to dump an instamine for a profit?

6) If it were a scam, would there have been extensive resources devoted to development over the subsequent 19+ months to improve the coin?

7) If an “instamine” intentionally or unintentionally did occur, at this point does it pose a risk to investors (e.g., is there a risk that emissions could exceed the planned emissions from this point forward, thus diluting the coin’s value relative to its current risk / reward potential)?

Evan Duffield:“During this time, my life was in chaos. I was working a very challenging job while trying to fix this code for Dash (Xcoin at the time) late into the night and on weekends. The first month of the project is a blur, I was working about 120 hours a week. I was putting out fire after fire, obviously this was self inflicted. I can be impatient sometimes and I should have waited another week or two, to test all of the code thoroughly before launching.”

After the code was initially somewhat stable, Evan immediately started work on DarkSend. Why would he do that, if it was a scam?

Q: So now that we’ve established Dash was not setup to defraud investors in anyway. So what effect does this have on investors?

Evan Duffield:“Having the initial distribution up-front, before the coin gains traction allowed the Dash project to skip about two years of activity that Bitcoin went through in about a month. This was the case because initially coins were distributed and made their way to the founders, who got them for nothing. At this point, they could either sell or work on the project and make their investment worth more over time. This takes hard work and is a similar model to what we see in centralized companies. I believe all successful crypto-coins in our space have a distribution where the founders have more than 5% of the currency combined. In Dash, all of the founders combined have less than 10% total (of the current supply, not total).

If you compare that to Bitcoin for example, it was under the radar for nearly 2 years after the launch while enough coins made their way to founders to incentivize them to continue work on the project for the long term. It repeats for every other project that is successful as well, there are large holders putting significant effort into them. “

Q: What about other coins like Ripple, Litecoin, Stellar, Blackcoin, etc? Why are they still around?

Evan Duffield:“Ripple and Stellar are basically entirely owned by the operating company, so it qualifies as a 100% instamine in my opinion. So they are properly incentivized. However I disagree with the percentage they took for themselves, which is boosting their market value to very unrealistic levels.

Blackcoin and other coins like it also have instamines in my opinion. They were relatively unknown for the first 2 weeks, when you could actually mine for coins. After that they switched to proof-of-stake and made it impossible to get coins except by directly buying them.

Litecoin was also unknown at the beginning and it’s founders gained significant portions of coinage, which incentivized work. Litecoin is actually a perfect example of what I’m saying because, the founder sold most of his coins and he lost the incentive to work on the project and has left the coin without a captain.

The cryptonote coins and clones are also no exception to this rule. The software they use is hard and clunky to run, therefore a few founders got significant coinage and were incentivized to work on the project early on. I would consider all of them in the same class, an instamine. Any coin which has founders with more than 5% of the coin supply is an instamine (including Bitcoin).

I would love proof that any of these projects don’t qualify, but I doubt it.”

Q: If you could start Dash over again, how would you do it now?

Evan Duffield:“I would test the code for a month or two before launch, with a team of people. The founders. We would publish that we are the ‘core-team’ that is going to be behind the project. We would then set up a structure where we had an initial distribution of 10% divided between us and publish a sort of bylaws that we all sign, stating that if we sell any coins we must provide notice 30-days before the sale. I think this is a fair way to start a virtual corporation, then the community has a fair understanding of how much we have. Checkout my video about Virtual Corporations if you want more information on how I believe these types of entities should be setup”

Q: Do you think anyone was hurt by the instamine?

Evan Duffield:“I believe the lower emission rate caused by the instamine benefits all involved in the currency. No one was ever hurt by it. In fact, the earliest miners got the coins for free and either turned into founders or they sold and made a bit of money. The founders stayed around and worked on the project diligently because we believe in it, so the next rush of investors benefited the greatest. The project was a success and made it, now we have a secure foundation for the future.”

Q: What do you mean by “The lower emission rate caused by the instamine benefits all involved in the currency?”

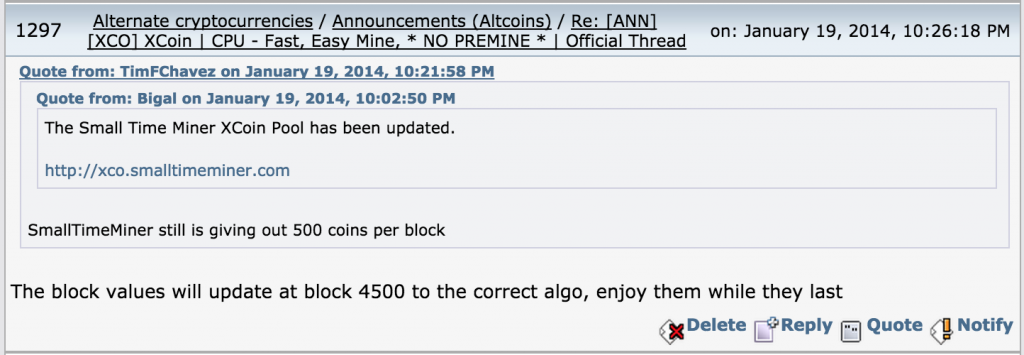

Evan Duffield:“The emission rate is the amount of coins that’s currently being generated by the network. Before the block 4500 bug, we were generating nearly 2M coins per day. That is excessive and would have destroyed the coin in no time, so intervening was absolutely necessary. If I had not intervened, the project would surely be dead.

The counter-intuitive part is that because of the high emission rate early on, our coin was distributed to more people faster than it would have been otherwise. Because of the lower inflation rates (compares to other distribution models), we have a better environment for investment. This is good for everyone involved in Dash.“

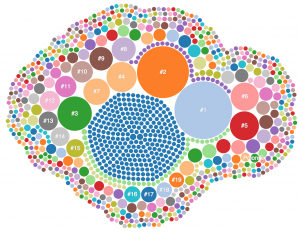

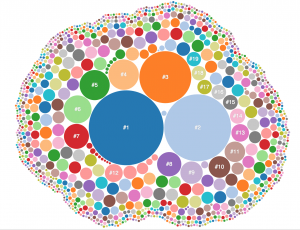

So what’s the distribution look like you ask? Well let’s take a look

| Dash | Litecoin |

|

|

Looks like a pretty healthy distribution, that is quite more distributed than Litecoin (market cap of nearly 8x Dash).

Q: Anything else you want to say about the instamine?

Evan Duffield:“If you look at the cryptocurrency space, 99% of the currencies fail because their mining is based on Bitcoin’s algorithm which was quite ‘fair’. However, it doesn’t work anymore for newer coins because not enough distribution of the coin supply goes to the founders (the ones that actually do the work). So there’s not enough incentive to work on the project, because there’s a bunch of miners looking to make some money by dumping coins they got for free, so the founders get frustrated and dump their coins. This happens over and over again.

The entire crypto-community needs to realize everyone needs incentives to work and no one is working for free. No crypto-currency is immune to this fact, it’s just pure and simply economics in action. It’s also worth noting, the coins that the founders got from the instamine were worthless until they spent significant effort trying to develop the ecosystem and product into something people wanted to use. Founders don’t get something for nothing, instead they get something that is worth nothing. We turned that founding share into something valuable by spending an incredible amount of effort on the coin.

I think there’s a good comparison can be made to centralized companies. They start out by issuing shares to their investors in exchange for seed funding, then the rest of the company (usually about half) goes to the founders, which provides incentive to work on the company and make it worth more.

What would happen if you setup a centralized company like Bitcoin (This is for illustrative purposes only)? To begin, we’ll issue some shares, and they go to all of the founders, investors and end-users equally. What happens next when the company starts taking off? Early adopting end-users who didn’t do any of the work start dumping their shares and make tons of money, eventually killing the motivation of the founders to continue working on the project. It makes as much sense to setup a company this way as it doesn’t a crypto-currency. This is the reason why Dash is a success. If you don’t like that it was an instamine, that’s fine, go invest in something else. ”